It's Halloween, and I'm spending the day recovering from my weekend in Pittsburgh (boo). While I'm doing that, you can all enjoy these really cool pumpkin carvings, which are miles beyond what I could ever accomplish with a Jack-o'-lantern. After this weekend, I feel sort of like a combination of these four guys. You can also take a look at some crazy pics from Heidi Klum's Vegas Halloween Party--once again, she wins the holiday.

(h/t Barry Ritholtz)

A trader's view on business, sports, finance, politics, The Simpsons, cartoons, bad journalism...

Monday, October 31, 2011

Friday, October 28, 2011

A step in the right direction

Given my past rants about the flaws in collegiate athletics, I'd be remiss if I didn't at least mention the developments from yesterday in the NCAA.

For now, it seems that the NCAA knew that the widespread conference realignment/money grab/three-ring circus would likely create a significant public relations backlash, and it therefore scrambled to save face or at least divert attention. Whatever the reasons, though, it's undeniably the right move. Is it enough? We'll see.

[ESPN]

The scandal-plagued NCAA is moving swiftly to clean up its image.

On Thursday, the Division I Board of Directors approved a package of sweeping reforms that gives conferences the option of adding more money to scholarship offers, schools the opportunity to award scholarships for multiple years, imposes tougher academic standards on recruits and changes the summer basketball recruiting model.

"It was one of the most aggressive and fullest agendas the board has ever faced," NCAA President Mark Emmert said. "They moved with dispatch on it, and I think they're taking positive steps for schools and student-athletes."

For decades, outsiders have debated whether college scholarships should include more than just the cost of tuition, room and board, books and fees. Now they can.

The board approved a measure allowing conferences to vote on providing up to $2,000 in spending money, or what the NCAA calls the full cost-of-attendance. Emmert insists it is not pay-for-play, merely the reintroduction of a stipend that existed for college athletes until 1972. He also compared it to the stipends received by other students who receive non-athletic scholarships.

Some thought the total amount should have been higher. At the Big Ten's basketball media day in Chicago, commissioner Jim Delany said studies have shown the average athlete pays roughly $3,000 to $4,000 out of his or her own pocket in college costs.

But many believe the measure is long overdue.I'll leave a more complete analysis until later, when more details about these reforms become available, but for now this seems to be a significant step in the right direction. It certainly isn't sufficient to address the widespread inequities that still exist, but to be fair, addressing them completely would probably mean a wholesale destruction of collegiate athletics as we know them.

For now, it seems that the NCAA knew that the widespread conference realignment/money grab/three-ring circus would likely create a significant public relations backlash, and it therefore scrambled to save face or at least divert attention. Whatever the reasons, though, it's undeniably the right move. Is it enough? We'll see.

[ESPN]

Thursday, October 27, 2011

Clip of the Week

Alright, good times this week. Let's all enjoy some mindless internet video, shall we?

This guy here is terrified of puppies, which is sort of humorous if you like laughing at other people's severe psychoses (guilty). If you're into college football, you'll probably see replays of this play for a long time. And if you enjoyed this video from Clarke & Dawe, then you'll enjoy this one as well.

Following along with my theme of innovation and technology, I highly suggest you watch this video about a new (and safer) technology for in-car navigation systems. Very cool stuff.

And yet, that still wasn't the coolest technology-related video I came across this week. This was. Liquid nitrogen + magnets = awesome. I seriously can't stop watching this video. Also, I want a hoverboard.

This guy here is terrified of puppies, which is sort of humorous if you like laughing at other people's severe psychoses (guilty). If you're into college football, you'll probably see replays of this play for a long time. And if you enjoyed this video from Clarke & Dawe, then you'll enjoy this one as well.

Following along with my theme of innovation and technology, I highly suggest you watch this video about a new (and safer) technology for in-car navigation systems. Very cool stuff.

And yet, that still wasn't the coolest technology-related video I came across this week. This was. Liquid nitrogen + magnets = awesome. I seriously can't stop watching this video. Also, I want a hoverboard.

More Fairfax

A couple of days ago I used an example from Fairfax, Virginia to help prove a point about the dangers of over-regulation. But maybe I was wrong. Maybe people in Fairfax, Virginia just suck. To wit...

[Washington Post]

A dispute between neighbors in Fairfax County over that perennial suburban pet peeve — unscooped dog poop — has grown so big that the case is set to go to a jury Tuesday.

A dog walker invested $1,200 in her defense, and a supposed eyewitness will testify. A photo of the offending pile will be admitted as evidence.

The fluffy 19-pound Westie-bichon frise mix will stay home.

The case is just one flash point in an increasingly sophisticated, expensive and acrimonious battle over dog waste in the Washington suburbs and beyond. Two Northern Virginia apartment complexes have signed on for PooPrints, a service that collects DNA samples from pooches, taking a “CSI”-style approach to find the culprits of unclaimed messes...

[Complainant Virginia] Cornell, who works in the legal profession, said she took a photo of the waste that she plans to submit as evidence at trial, along with testimony from the police officer who took the complaint.

“She was letting the dog poop on purpose because she knew it annoyed us,” Cornell said, referring to herself and a sister who lives with her. “This individual has no respect or regard for anyone else and views herself as above the law.”You people are morons. Stop wasting our courts' time with this crap (pun intended). DNA samples from piles of dog excrement? That's what we've come to? Seriously, get this thing out of our courts and figure it out yourselves. I'm tired of this, and we've got bigger things to worry about up there in the D.C. area right now. I love Virginia, but there are days where I really wish I could disown Northern Virginia. Today is most certainly one of those days.

[Washington Post]

Wednesday, October 26, 2011

Science-speak

I've come across this chart in a couple of places recently, and I think it's an interesting study on the occasional ambiguity of language, especially in scientific literature. More specifically, it details a number of words that are consistently defined differently by the scientific community and the general public.

Any time that we attempt to speak about quantitative values in qualitative terms (especially when it pertains to risk and probability), we run the risk that our message could be lost in translation. I've often noticed this definitional disparity with probability words like "can", "could", "may", and "might"--these words can have a wide degree of variety in meaning from one person to the next, a dynamic that is discussed and studied at length here.

Usually, this kind of miscommunication is unintentional and harmless, but certain devious individuals could of course use their knowledge of these gaps in order to take advantage of the general public (cough, Dr. Oz, cough). As members of the general public, we would do well to be aware of these possible discrepancies, and to focus on the data rather than the prose that describes it. But unfortunately, that's where America's innumeracy problem really shows its teeth--when it comes to math, most Americans just don't understand. Words matter, but math matters more.

Any time that we attempt to speak about quantitative values in qualitative terms (especially when it pertains to risk and probability), we run the risk that our message could be lost in translation. I've often noticed this definitional disparity with probability words like "can", "could", "may", and "might"--these words can have a wide degree of variety in meaning from one person to the next, a dynamic that is discussed and studied at length here.

Usually, this kind of miscommunication is unintentional and harmless, but certain devious individuals could of course use their knowledge of these gaps in order to take advantage of the general public (cough, Dr. Oz, cough). As members of the general public, we would do well to be aware of these possible discrepancies, and to focus on the data rather than the prose that describes it. But unfortunately, that's where America's innumeracy problem really shows its teeth--when it comes to math, most Americans just don't understand. Words matter, but math matters more.

Tuesday, October 25, 2011

Quote of the Week

I have to admit I'm a little bit proud of myself this week for posting Quote of the Week on its proper day (instead of a day late) and with an actual quote from a human being (as opposed to a cartoon character or a magazine cover). Of course, Quote of the Week is one of those funny little things that relies on somebody else's cleverness (or utter lack thereof) in order to succeed, and sometimes that cleverness is in short supply.

But not this week. At first, I was all prepared to post a couple of gems from Lemony Snicket's "Occupy Writers", a short list of witty observations about the ongoing "Occupy Wall Street" demonstrations ("Historically, a story about people inside impressive buildings ignoring or even taunting people standing outside shouting at them turns out to be a story with an unhappy ending" is a personal favorite, and it was the frontrunner for this week's honor for a while). But then I read an article about Europe and its comically dysfunctional response to its ongoing debt crisis that made me crack up laughing.

Seriously, if this European situation gets any more absurd, I'm just going to go on assuming that all of Europe is one giant Benny Hill Show scene. Without further ado...

This week's QUOTE OF THE WEEK

"We need to impress the market with the size of our equipment, so to speak."

- Anonymous EU source

Perfect, just perfect. All will be well if we just show the market our junk--it's the Brett Favre Theory of monetary intervention. I mean, wow. All that quote needs is a creepy wink and an eyebrow raise to complete the effect. It's almost better that the speaker was anonymous, so that I can go on assuming that it's a lewd Frenchman (ahem) who gave the interview while half-drunk and half-naked.

But not this week. At first, I was all prepared to post a couple of gems from Lemony Snicket's "Occupy Writers", a short list of witty observations about the ongoing "Occupy Wall Street" demonstrations ("Historically, a story about people inside impressive buildings ignoring or even taunting people standing outside shouting at them turns out to be a story with an unhappy ending" is a personal favorite, and it was the frontrunner for this week's honor for a while). But then I read an article about Europe and its comically dysfunctional response to its ongoing debt crisis that made me crack up laughing.

Seriously, if this European situation gets any more absurd, I'm just going to go on assuming that all of Europe is one giant Benny Hill Show scene. Without further ado...

This week's QUOTE OF THE WEEK

"We need to impress the market with the size of our equipment, so to speak."

- Anonymous EU source

Perfect, just perfect. All will be well if we just show the market our junk--it's the Brett Favre Theory of monetary intervention. I mean, wow. All that quote needs is a creepy wink and an eyebrow raise to complete the effect. It's almost better that the speaker was anonymous, so that I can go on assuming that it's a lewd Frenchman (ahem) who gave the interview while half-drunk and half-naked.

This is really one of those times where I'm not sure whether to laugh or cry... Europe is so screwed.

When regulatory bodies go wild

In the aftermath of the 2008-09 financial crisis, there has understandably been broad support for "more regulation", particularly in the banking world. In many cases, increased oversight by a government or independent body is indeed both warranted and helpful. But this is not always the case, and unintended consequences abound--when the power dynamic shifts too far from the regulated to the regulator, who will be the watchdog's watchdog?

Along those lines, I've recently come across a couple of examples that highlight what happens when a regulatory body becomes too powerful for its own good. First, from nearby Fairfax County, Virginia:

Unfortunately, this isn't the only recent example of blind (and tone-deaf) adherence to the letter of the law over the spirit of the law. From Pittsburgh:

When regulatory bodies begin to hide behind their own policies and rules rather than abiding by the spirit of their existence, these kinds of outcomes are inevitable. We may feel better knowing that oversight agencies exist, but the power we imbue them with can easily corrupt them. The job of oversight must ultimately come back to the citizens themselves--if we enlist a middle man agency to do our oversight for us, all we have done is shift the power from one group to another. We still must keep our eye on the regulatory agency, to ensure that they are not abusing their power and leading to undesirable outcomes (cough, the Fed, cough). We all must be the watchdog's watchdog.

[MyFoxDC]

[Pittsburgh Post-Gazette]

Along those lines, I've recently come across a couple of examples that highlight what happens when a regulatory body becomes too powerful for its own good. First, from nearby Fairfax County, Virginia:

A father's promise for a treehouse is turning into a lesson in bureaucracy.

Before he left on his last deployment to Iraq, Mark Grapin promised his two boys he would build a treehouse when he got home.

But Fairfax County officials say it is a violation of zoning laws.

Living out a childhood dream, Eric and Sean Grapin helped their father build the sturdy treehouse, complete with a slide, two climbing ropes, a shingled roof, and even shutters to match the homes in the neighborhood.

“I built the treehouse as a kept promise to my boys,” said Grapin.

It was something for the boys to look forward to when Mark, an Army Aviation Specialist, would return back to Falls Church from Iraq.

And this is no shack, it took $1,400 dollars worth of materials, six weeks of hard labor, and the boys even earned scout badges for their masterpiece.

“It fits in the neighborhood, it’s part of raising children, it is what’s expected in a single bedroom community,” said Grapin.But, of course, overly broad zoning laws make this kind of thing technically illegal. A special wag of the finger should also go to the "anonymous neighbor" who blew the whistle on the zoning violation in the first place. When we go running to the regulators instead of settling our neighborly disputes face-to-face, we know the needle has moved a bit too far in the regulatory direction.

Unfortunately, this isn't the only recent example of blind (and tone-deaf) adherence to the letter of the law over the spirit of the law. From Pittsburgh:

Steelers safety Troy Polamalu was fined $10,000 by the National Football League for talking on a cell phone while sitting on the bench during the game against Jacksonville, the league announced Friday.

Mr. Polamalu borrowed a cell phone from a team trainer Sunday to let his wife know he was OK after leaving the game against the Jaguars with concussion-like symptoms. League rules state: "possession of cell phones, [personal digital assistants] or other electronic equipment in the bench area during a game is strictly prohibited by league policy beginning 90 minutes before kickoff through the end of the game."...

At his weekly news conference earlier this week, Steelers coach Mike Tomlin defended Polamalu's use of the cell phone.

"He has had a history of concussion-like symptoms in the past," Mr. Tomlin said. "[Mr. Polamalu's wife] was concerned. In this era of player safety, you would think that common sense would prevail in some of these things. It wasn't a personal call. He wasn't checking on his bank account."...

The NFL has a long-standing policy on use of electronic equipment during games to protect the integrity of the game. The league does not want coaches or players using electronic equipment to gain a competitive advantage.In this case, it seems that in trying to "protect the integrity of the game", the league has ironically damaged the integrity and reputation of the league itself. Troy Polamalu is one of the game's brightest stars, and he is by all accounts a solid citizen and a positive representative and ambassador for the league. But because he wanted to tell his wife he was okay, he got fined $10k. Granted, that kind of money is pocket change to a player who is due to earn more than $6 million this year (in addition to huge endorsement money from Head & Shoulders), but that's clearly not the point here.

When regulatory bodies begin to hide behind their own policies and rules rather than abiding by the spirit of their existence, these kinds of outcomes are inevitable. We may feel better knowing that oversight agencies exist, but the power we imbue them with can easily corrupt them. The job of oversight must ultimately come back to the citizens themselves--if we enlist a middle man agency to do our oversight for us, all we have done is shift the power from one group to another. We still must keep our eye on the regulatory agency, to ensure that they are not abusing their power and leading to undesirable outcomes (cough, the Fed, cough). We all must be the watchdog's watchdog.

[MyFoxDC]

[Pittsburgh Post-Gazette]

Monday, October 24, 2011

Still more marathon badassery

It's been a while since I had an entry in this series, but yeah... it's time.

[WGN]

[CBC]

One of the 45,000 people who ran in the Bank of America Chicago Marathon [October 9th] was 38 weeks and five days pregnant.

Amber Miller crossed the finish line then gave birth to her second child, a bouncing baby girl.

June Miller was born at 10:29 p.m., weighing 7 pounds, 13 ounces.

"We signed up for the race in February, and then two days later I found out I was pregnant," Amber Miller told reporters today at Central DuPage Hospital in Winfield. "I wasn't real determined to run, and I kind of thought I would have already had the baby. And you know, it comes to the night before, I'm still pregnant -- and I paid for it, so I'm gonna run it."And yet, that incredible act of child endangerment (wait, what?) wasn't the only crazy marathon story to have come out this month. From our friends up in America's Hat...

Fauja Singh, 100, finished Toronto's waterfront marathon Sunday evening, securing his place in Guinness World Records as the oldest person — and the first centenarian — to ever accomplish a run of that distance.

Singh, a British citizen, was the last person to complete the race, crossing the finish line just before 6 p.m. ET with a time of 8 hours, 11 minutes and 5.9 seconds.Okay, so no, the old man's time isn't exactly "impressive", but holy crap... I'll be happy if I can stay awake for 8 hours and 11 minutes when I'm 100... wait, who are we kidding, I've got no shot of reaching 100 in the first place. This guy wins. Sweet beard, too.

[WGN]

[CBC]

Friday, October 21, 2011

The new immigration?

I sincerely doubt that this bill will get any traction, given the overall political trend against immigration (and toward protectionism), but it seemed almost inevitable that something like this would come along.

Either way, I'm always amused to see how far our politicians will go in their attempts to prop up old regimes. Here, they're basically willing to pull out all the stops in order to prevent a further deterioration in the housing market. Generally speaking, these sort of desperate attempts fail miserably, and serve only to create all manner of unintended consequences that we will later regret.

This kind of policy, when combined with ultra-low-interest-rate policy from the Fed (that serves to weaken the dollar against other currencies) will ensure that our primary "export" over the coming decades will not be any sort of product or service, but the very land that we live on. If more and more of our country is actually physically owned by foreigners, are we really even a country any more? And does it even matter?

Welcome to the 21st century, I guess--and welcome to the strange, existential questions that we never thought we'd have to ask ourselves.

[Wall Street Journal]

The reeling housing market has come to this: To shore it up, two Senators are preparing to introduce a bipartisan bill Thursday that would give residence visas to foreigners who spend at least $500,000 to buy houses in the U.S.

The provision is part of a larger package of immigration measures, co-authored by Sens. Charles Schumer (D., N.Y.) and Mike Lee (R., Utah), designed to spur more foreign investment in the U.S.

Foreigners have accounted for a growing share of home purchases in South Florida, Southern California, Arizona and other hard-hit markets. Chinese and Canadian buyers, among others, are taking advantage not only of big declines in U.S. home prices and reduced competition from Americans but also of favorable foreign exchange rates.

To fuel this demand, the proposed measure would offer visas to any foreigner making a cash investment of at least $500,000 on residential real-estate—a single-family house, condo or townhouse. Applicants can spend the entire amount on one house or spend as little as $250,000 on a residence and invest the rest in other residential real estate, which can be rented out.

The measure would complement existing visa programs that allow foreigners to enter the U.S. if they invest in new businesses that create jobs. Backers believe the initiative would help soak up an excess supply of inventory when many would-be American home buyers are holding back because they're concerned about their jobs or because they would have to take a big loss to sell their current house.This kind of bill would only speed up the dynamic that we've already begun to see in Texas, where the "new immigrant" is not a day laborer but an opportunistic investor. This shift may change the way we view immigration and immigrants in our country as we enter into a new century with new economic realities.

Either way, I'm always amused to see how far our politicians will go in their attempts to prop up old regimes. Here, they're basically willing to pull out all the stops in order to prevent a further deterioration in the housing market. Generally speaking, these sort of desperate attempts fail miserably, and serve only to create all manner of unintended consequences that we will later regret.

This kind of policy, when combined with ultra-low-interest-rate policy from the Fed (that serves to weaken the dollar against other currencies) will ensure that our primary "export" over the coming decades will not be any sort of product or service, but the very land that we live on. If more and more of our country is actually physically owned by foreigners, are we really even a country any more? And does it even matter?

Welcome to the 21st century, I guess--and welcome to the strange, existential questions that we never thought we'd have to ask ourselves.

[Wall Street Journal]

Clip of the Week

Now this was a great week for Clip of the Week options. So great that I completely forgot to post it up here yesterday. Not the first time, won't be the last.

So, let's have at it. This video from last weekend's UCLA-Arizona football game is one of the strangest, craziest things I've ever seen--a fan dressed as a referee runs onto the field blowing a whistle, stops play, then runs away... and as this is all happening, a brawl breaks out on the field. Sure. Why not?

For the animal lovers out there, we've got this video of a cat trying to fight invisible hot air from a hair dryer, and we've got this video of a thieving penguin (I told you never to trust a flightless bird).

We've also got a pretty cool technological development with this throwable ball-shaped panoramic camera, which is almost too cool not to purchase. And for the Police Academy fans out there, our old human sound machine Michael Winslow is back with this awesome video of him covering Led Zeppelin's "Whole Lotta Love"--um, yeah, he's imitating an electric guitar solo. And his vocals aren't bad, either.

The Red Cowboy passed along this great Jon Stewart clip (it follows along in the Occupy Wall Street theme), but I've gone that route too many times here already.

Instead, I'm going to post this video of the greatest Hot Wheels track ever. More than anything else, this makes me wish that YouTube had been around when I was a kid. I did enough crazy and stupid crap without the opportunity to post it on the internet for the whole world to see. If YouTube had existed in 1989, I might be famous by now. Or dead. You know, whichever. Enjoy.

And if that doesn't do it for you, then just go watch this music video for Toby Keith's "Red Solo Cup". Then you can have the song stuck in your head for a week like me.

So, let's have at it. This video from last weekend's UCLA-Arizona football game is one of the strangest, craziest things I've ever seen--a fan dressed as a referee runs onto the field blowing a whistle, stops play, then runs away... and as this is all happening, a brawl breaks out on the field. Sure. Why not?

For the animal lovers out there, we've got this video of a cat trying to fight invisible hot air from a hair dryer, and we've got this video of a thieving penguin (I told you never to trust a flightless bird).

We've also got a pretty cool technological development with this throwable ball-shaped panoramic camera, which is almost too cool not to purchase. And for the Police Academy fans out there, our old human sound machine Michael Winslow is back with this awesome video of him covering Led Zeppelin's "Whole Lotta Love"--um, yeah, he's imitating an electric guitar solo. And his vocals aren't bad, either.

The Red Cowboy passed along this great Jon Stewart clip (it follows along in the Occupy Wall Street theme), but I've gone that route too many times here already.

Instead, I'm going to post this video of the greatest Hot Wheels track ever. More than anything else, this makes me wish that YouTube had been around when I was a kid. I did enough crazy and stupid crap without the opportunity to post it on the internet for the whole world to see. If YouTube had existed in 1989, I might be famous by now. Or dead. You know, whichever. Enjoy.

And if that doesn't do it for you, then just go watch this music video for Toby Keith's "Red Solo Cup". Then you can have the song stuck in your head for a week like me.

Thursday, October 20, 2011

This is an absolutely crazy story

Shortly before Tuesday's NFL trade deadline, the Detroit Lions and Philadelphia Eagles agreed to a swap of backup running backs in what appeared to be a fairly standard, unremarkable transaction. The Eagles' Ronnie Brown for the Lions' Jerome Harrison, plus a future draft pick. No big deal, nothing earth-shattering.

When news broke last night that the deal had been nixed because Harrison had failed his physical, it was again unsurprising news. Football players, especially running backs, take quite a beating, and I of course assumed that Harrison had something wrong with his knee or ankle. Um, no. Turns out this was far from a standard failed physical.

Had Lions starting running back Jahvid Best not gotten hurt last week, the Harrison trade likely would never have occurred, and Harrison would not have had a physical. The early detection may in fact have a huge impact on how he is able to treat and recover from this tumor, and how his life proceeds from here.

This kind of stuff blows my mind. It's scary sometimes to think how events we can't control can shape our lives, but in this case we (hopefully) have a happy ending to share.

[ESPN]

When news broke last night that the deal had been nixed because Harrison had failed his physical, it was again unsurprising news. Football players, especially running backs, take quite a beating, and I of course assumed that Harrison had something wrong with his knee or ankle. Um, no. Turns out this was far from a standard failed physical.

As Philadelphia Eagles doctors were giving newly acquired running back Jerome Harrison his physical, they discovered a brain tumor that nullified a trade with the Detroit Lions, according to two league sources.

The trade might have actually saved Harrison's life, the sources said. Without the deal being made, Harrison would not have undergone a physical. The tumor is now being treated, according to sources...

Harrison is not expected to play again this season, but his long-term prognosis both for life and his football career appear to be good, sources said. He is visiting with more doctors Thursday.Wow. I'm often remarking that while we all like to think of ourselves as being in control of our own lives and our own fate, this is of course far from the case. Our lives and what becomes of them are often as much a case of lucky accidents and flukes of timing as they are a result of our conscious actions and decisions. The Jerome Harrison case is a particularly extreme example of the often significant power of serendipity in our lives.

Had Lions starting running back Jahvid Best not gotten hurt last week, the Harrison trade likely would never have occurred, and Harrison would not have had a physical. The early detection may in fact have a huge impact on how he is able to treat and recover from this tumor, and how his life proceeds from here.

This kind of stuff blows my mind. It's scary sometimes to think how events we can't control can shape our lives, but in this case we (hopefully) have a happy ending to share.

[ESPN]

Come on, Europe

These guys really don't seem to get it. This latest proposal out of Europe is so far beyond absurd that I'm not even sure how to respond.

A big part of the reason that American banks (especially Bank of America and Morgan Stanley) have found their stocks under such extreme pressure this year (BofA is down 52% year-to-date--from 13.34 to 6.37--even after a 24% rally in the last two weeks; MS is down 40%--from 27.25 to 16.25--even after a 40% rally off its low of 11.58) is that people don't know what they've got on their balance sheets, and can't possibly trust the bank's valuations without proper mark-to-market accounting.

Accounting fraud (or, at least, lack of accounting transparency) is NOT GOOD for stock valuations--in order for people to hold a stock, they must be willing and able to believe that what the company is telling them in their financial statements is actually true. Any opaqueness or obfuscation of truth is typically a death knell for the stock, as it allows rumor-mongering to take hold. There is little that any bank can do to defend itself against those rumors once they have taken charge, since their own lack of transparency is what empowered the rumor-mongerers in the first place.

Governments should and must know that the same rule applies to them and their debt. If people can't trust what a government is telling them, they won't buy their debt, plain and simple. Forcing rating agencies to tell people that "all is well" absolutely will not help matters. It will simply make it even harder for investors to derive the truth of the matter, which will erode their confidence and lead to frequent panics.

This latest proposal is, unfortunately, eerily familiar to those of us in the United States. It was just two months ago that the S&P ratings agency downgraded U.S. sovereign debt from its AAA rating to AA+ in the wake of the debt ceiling madness that showed us Washington at its worst. Washington's immediate response? No, it wasn't humble acceptance that perhaps their political process had some flaws that could be addressed--it was to launch an investigation of S&P for misconduct in their ratings process.

This kind of political grandstanding is wrongheaded, arrogant, and flat-out stupid. You can't change the truth simply by forcing people not to speak about it. In fact, as we've seen with banks and their toxic assets, hiding the truth simply makes you even less capable of changing it, creating a self-fulfilling prophecy.

[Mish Shedlock]

In a confidential preliminary plan to reform the law on credit rating agencies, EU Internal Market Commissioner Michel Barnier seeks to prohibit rating agencies from publishing judgments about ailing EU countries.

Barnier proposes that the new Securities and Exchange ESMA is granted the right "to temporarily prohibit" the disclosure of assessments of the ability to pay.

Barnier has advised the rule take effect in November and wants to hold rating agencies civilly liable for damage caused by "poor" ratings.Look, guys, you can't change the facts just by prohibiting people from speaking them. I mentioned yesterday in my Bank of America rant that toxic financial assets never went away or recovered value after 2008-09, they merely disappeared from public view due to an ill-advised relaxation of mark-to-market accounting rules. This was great for the banks in the short-term, and it allowed them to show book "profits" even while holding toxic garbage on their balance sheet. But now, we're seeing the flip-side of that balance sheet opaqueness.

A big part of the reason that American banks (especially Bank of America and Morgan Stanley) have found their stocks under such extreme pressure this year (BofA is down 52% year-to-date--from 13.34 to 6.37--even after a 24% rally in the last two weeks; MS is down 40%--from 27.25 to 16.25--even after a 40% rally off its low of 11.58) is that people don't know what they've got on their balance sheets, and can't possibly trust the bank's valuations without proper mark-to-market accounting.

Accounting fraud (or, at least, lack of accounting transparency) is NOT GOOD for stock valuations--in order for people to hold a stock, they must be willing and able to believe that what the company is telling them in their financial statements is actually true. Any opaqueness or obfuscation of truth is typically a death knell for the stock, as it allows rumor-mongering to take hold. There is little that any bank can do to defend itself against those rumors once they have taken charge, since their own lack of transparency is what empowered the rumor-mongerers in the first place.

Governments should and must know that the same rule applies to them and their debt. If people can't trust what a government is telling them, they won't buy their debt, plain and simple. Forcing rating agencies to tell people that "all is well" absolutely will not help matters. It will simply make it even harder for investors to derive the truth of the matter, which will erode their confidence and lead to frequent panics.

This latest proposal is, unfortunately, eerily familiar to those of us in the United States. It was just two months ago that the S&P ratings agency downgraded U.S. sovereign debt from its AAA rating to AA+ in the wake of the debt ceiling madness that showed us Washington at its worst. Washington's immediate response? No, it wasn't humble acceptance that perhaps their political process had some flaws that could be addressed--it was to launch an investigation of S&P for misconduct in their ratings process.

This kind of political grandstanding is wrongheaded, arrogant, and flat-out stupid. You can't change the truth simply by forcing people not to speak about it. In fact, as we've seen with banks and their toxic assets, hiding the truth simply makes you even less capable of changing it, creating a self-fulfilling prophecy.

[Mish Shedlock]

Wednesday, October 19, 2011

A trip down Memory Lane

I had a brief moment of fun this morning when I was alerted to the fact that John Beck is poised to become the Washington Redskins' 13th starting quarterback since the 2000 season. Oh, what a good laugh I had at that one.

"Ha! Stupid Redskins," I laughed while glancing over at my Patriots Super Bowl Champions mug. "The Patriots have only used 3 quarterbacks since 2000! Tom Brady has started 149 games in that time, more than the top 6 Redskins quarterbacks (Jason Campbell, Mark Brunell, Patrick Ramsey, Tony Banks, Donovan McNabb, Brad Johnson) combined! I've seen college teams that use fewer starting quarterbacks! Who the hell is Tony Banks!?!?"

Yup, it was a fun time. But then, suddenly, I was interrupted by a strange, nagging feeling. It almost felt as if... this Redskins futility... was oddly familiar. Then I realized that, for all the good luck that my Patriots have had in the Brady/Bledsoe era, and for all of the titles that my Boston teams have won in recent years... good God, the Red Sox have trotted out some seriously awful starting pitchers.

Yeah, I took a look back... and it turns out that, since 2000, the Red Sox have used... HOLY CRAP!! 66 different starting pitchers!!! That's not a pitching rotation, that's a pitching conveyor belt! Only three times since 2000 have the Red Sox used fewer than 10 starting pitchers in a season (not coincidentally, in two of those years--2004 and 2007--they won the World Series; in the third, 2010, their entire lineup got hurt and they missed the playoffs entirely), peaking at a ridiculous 14 in 2006.

Yup. Redskins fans, I sympathize with you. My football team may not know the agony of awful starting quarterbacks (well... we used to), but my baseball team certainly feels your pain. I think in some of those years we would've been better off with Mark Brunell or Jeff George toeing the rubber than, say, Kason Gabbard or Darren Oliver.

Now, if you don't care about the Red Sox, or this sort of stuff doesn't amuse you, move along... I'll have more bank-related rants later to keep everyone happy. But for the rest of you, come join me on this trip down Memory Lane--brought to you by... oh, let's say Rolando Arrojo.

Since 66 pitchers is way too many for me to wrap my head around, it's clear that some categorization is necessary. My buckets here are arbitrary, meaningless, and amusing. That's the point. Come on, let's have some fun.

The Studs (564 total starts)

Pedro Martinez (139), Curt Schilling (98), Josh Beckett (173), Jon Lester (154)

These guys are aces, and they're durable. They're a big part of the reason the Red Sox have won two World Series in the last decade (Lester less so, but bear with me), and they've combined to start 29% of the Red Sox' games in the last dozen years. Sure, Beckett and Lester might have been crushing beers in the dugout this year, but whatever. At least they get guys out.

Tim Wakefield (292 total starts)

Yeah, I gave him his own category. So sue me. He's been with the team for the entire dozen years, and he's started games in every one of them. He alone has started 15% of Red Sox games this century, and that's just ridiculous. We won't see many like him ever again.

The Complementary Pieces (286 total starts)

Derek Lowe (101), Clay Buchholz (76), Bronson Arroyo (61), Matt Clement (44), Alfredo Aceves (4)

These are your middle-of-the-rotation guys--they're not gonna single-handedly win you any titles, but they are capable of being important pieces on some title-winning teams (and Lowe and Arroyo certainly were). You need some of these guys. Just not a rotation full of them.

The Johns (133 total starts)

John Lackey (61), John Burkett (59), John Smoltz (8), Jonathan Papelbon (3), John Halama (1), John Wasdin (1)

Their names are all John (or Jonathan--he didn't really fit anywhere else... whatever). They all pitched for the Red Sox. Most of them sucked.

The Asians (179 total starts)

Daisuke Matsuzaka (105), Hideo Nomo (33), Tomo Ohka (23), Byung-Hyun Kim (8), Sun-Woo Kim (4), Junichi Tazawa (4), Bruce Chen (2)

Yeah, that's right. I lumped them all together. Some of them were better than others, but let's be honest--we basically consider them all to be the same guy. Except maybe Matsuzaka. He's... unique.

The Journeymen (255 total starts)

Frank Castillo (49), Rolando Arrojo (30), Julian Tavarez (29), Ramon Martinez (27), David Cone (25), Brad Penny (24), Wade Miller (16), Paul Byrd (14), Kyle Snyder (10), Jeff Suppan (10), Bartolo Colon (7), Jason Johnson (6), Ramiro Mendoza (5), Bret Saberhagen (3)

Most of these guys pitched in the majors for a long time. Some of them still do. We don't really know why. They didn't make much of an impact in Boston, though some of them (like Saberhagen, Cone, and Colon) certainly made marks elsewhere, before they got old and terrible. I forgot that half of these guys ever pitched for the Red Sox.

The Lefties (163 total starts)

David Wells (38), Casey Fossum (33), Jeff Fassero (23), Pete Schourek (21), Andrew Miller (12), Kason Gabbard (11), Darren Oliver (9), Erik Bedard (8), Lenny DiNardo (7), Abe Alvarez (1)

Seriously, these guys all basically suck, and yet they combined to account for a full season's worth of starts. The only one of them who had even a modicum of talent weighed a million pounds and was basically an affront to athletes everywhere. Every one of them is the reason why I'm tying my first-born son's right arm behind his back and forcing him to throw lefty. If you're left-handed, you'll last way too long in the majors on way too little talent.

The "Prospects" (59 total starts)

Justin Masterson (15), Brian Rose (12), Paxton Crawford (11), David Pauley (5), Kyle Weiland (5), Felix Doubront (3), Geremi Gonzalez (3), Devern Hansack (3), Michael Bowden (2)

To my recollection, all of these guys were considered "top prospects" at one time or another. Whoops. I'll apologize to Doubront, Weiland, and Bowden if they turn out to be something useful--until then, they stay here.

Who? What? (12 total starts)

Kevin Jarvis (3), Pedro Astacio (1), Scott Atchison (1), Hector Carrasco (1), Josh Hancock (1), Dustin Hermanson (1), Steve Ontiveros (1), Hipolito Pichardo (1), Ryan Rupe (1), Charlie Zink (1)

I seriously don't know who most of these guys are, or why they started games for the Red Sox. Okay, fine, I know most of them but banished any memory of them to the darkest recesses of my mind. Except for Kevin Jarvis. I very seriously have no idea who he is. I still think Baseball Reference might be playing a joke on me.

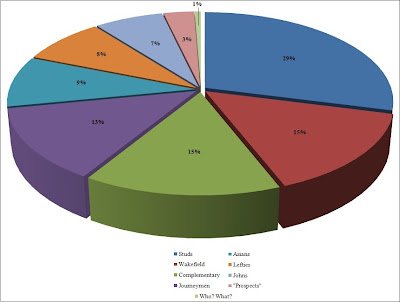

Hey, that's it... that's all of them. Here's a pie chart.

Wasn't that fun? Now, please, whoever is GM of the Sox next year... please pay someone to get rid of John Lackey. I can't take this much longer.

"Ha! Stupid Redskins," I laughed while glancing over at my Patriots Super Bowl Champions mug. "The Patriots have only used 3 quarterbacks since 2000! Tom Brady has started 149 games in that time, more than the top 6 Redskins quarterbacks (Jason Campbell, Mark Brunell, Patrick Ramsey, Tony Banks, Donovan McNabb, Brad Johnson) combined! I've seen college teams that use fewer starting quarterbacks! Who the hell is Tony Banks!?!?"

Yup, it was a fun time. But then, suddenly, I was interrupted by a strange, nagging feeling. It almost felt as if... this Redskins futility... was oddly familiar. Then I realized that, for all the good luck that my Patriots have had in the Brady/Bledsoe era, and for all of the titles that my Boston teams have won in recent years... good God, the Red Sox have trotted out some seriously awful starting pitchers.

Yeah, I took a look back... and it turns out that, since 2000, the Red Sox have used... HOLY CRAP!! 66 different starting pitchers!!! That's not a pitching rotation, that's a pitching conveyor belt! Only three times since 2000 have the Red Sox used fewer than 10 starting pitchers in a season (not coincidentally, in two of those years--2004 and 2007--they won the World Series; in the third, 2010, their entire lineup got hurt and they missed the playoffs entirely), peaking at a ridiculous 14 in 2006.

Yup. Redskins fans, I sympathize with you. My football team may not know the agony of awful starting quarterbacks (well... we used to), but my baseball team certainly feels your pain. I think in some of those years we would've been better off with Mark Brunell or Jeff George toeing the rubber than, say, Kason Gabbard or Darren Oliver.

Now, if you don't care about the Red Sox, or this sort of stuff doesn't amuse you, move along... I'll have more bank-related rants later to keep everyone happy. But for the rest of you, come join me on this trip down Memory Lane--brought to you by... oh, let's say Rolando Arrojo.

Since 66 pitchers is way too many for me to wrap my head around, it's clear that some categorization is necessary. My buckets here are arbitrary, meaningless, and amusing. That's the point. Come on, let's have some fun.

The Studs (564 total starts)

Pedro Martinez (139), Curt Schilling (98), Josh Beckett (173), Jon Lester (154)

These guys are aces, and they're durable. They're a big part of the reason the Red Sox have won two World Series in the last decade (Lester less so, but bear with me), and they've combined to start 29% of the Red Sox' games in the last dozen years. Sure, Beckett and Lester might have been crushing beers in the dugout this year, but whatever. At least they get guys out.

Tim Wakefield (292 total starts)

Yeah, I gave him his own category. So sue me. He's been with the team for the entire dozen years, and he's started games in every one of them. He alone has started 15% of Red Sox games this century, and that's just ridiculous. We won't see many like him ever again.

The Complementary Pieces (286 total starts)

Derek Lowe (101), Clay Buchholz (76), Bronson Arroyo (61), Matt Clement (44), Alfredo Aceves (4)

These are your middle-of-the-rotation guys--they're not gonna single-handedly win you any titles, but they are capable of being important pieces on some title-winning teams (and Lowe and Arroyo certainly were). You need some of these guys. Just not a rotation full of them.

The Johns (133 total starts)

John Lackey (61), John Burkett (59), John Smoltz (8), Jonathan Papelbon (3), John Halama (1), John Wasdin (1)

Their names are all John (or Jonathan--he didn't really fit anywhere else... whatever). They all pitched for the Red Sox. Most of them sucked.

The Asians (179 total starts)

Daisuke Matsuzaka (105), Hideo Nomo (33), Tomo Ohka (23), Byung-Hyun Kim (8), Sun-Woo Kim (4), Junichi Tazawa (4), Bruce Chen (2)

Yeah, that's right. I lumped them all together. Some of them were better than others, but let's be honest--we basically consider them all to be the same guy. Except maybe Matsuzaka. He's... unique.

The Journeymen (255 total starts)

Frank Castillo (49), Rolando Arrojo (30), Julian Tavarez (29), Ramon Martinez (27), David Cone (25), Brad Penny (24), Wade Miller (16), Paul Byrd (14), Kyle Snyder (10), Jeff Suppan (10), Bartolo Colon (7), Jason Johnson (6), Ramiro Mendoza (5), Bret Saberhagen (3)

Most of these guys pitched in the majors for a long time. Some of them still do. We don't really know why. They didn't make much of an impact in Boston, though some of them (like Saberhagen, Cone, and Colon) certainly made marks elsewhere, before they got old and terrible. I forgot that half of these guys ever pitched for the Red Sox.

The Lefties (163 total starts)

David Wells (38), Casey Fossum (33), Jeff Fassero (23), Pete Schourek (21), Andrew Miller (12), Kason Gabbard (11), Darren Oliver (9), Erik Bedard (8), Lenny DiNardo (7), Abe Alvarez (1)

Seriously, these guys all basically suck, and yet they combined to account for a full season's worth of starts. The only one of them who had even a modicum of talent weighed a million pounds and was basically an affront to athletes everywhere. Every one of them is the reason why I'm tying my first-born son's right arm behind his back and forcing him to throw lefty. If you're left-handed, you'll last way too long in the majors on way too little talent.

The "Prospects" (59 total starts)

Justin Masterson (15), Brian Rose (12), Paxton Crawford (11), David Pauley (5), Kyle Weiland (5), Felix Doubront (3), Geremi Gonzalez (3), Devern Hansack (3), Michael Bowden (2)

To my recollection, all of these guys were considered "top prospects" at one time or another. Whoops. I'll apologize to Doubront, Weiland, and Bowden if they turn out to be something useful--until then, they stay here.

Who? What? (12 total starts)

Kevin Jarvis (3), Pedro Astacio (1), Scott Atchison (1), Hector Carrasco (1), Josh Hancock (1), Dustin Hermanson (1), Steve Ontiveros (1), Hipolito Pichardo (1), Ryan Rupe (1), Charlie Zink (1)

I seriously don't know who most of these guys are, or why they started games for the Red Sox. Okay, fine, I know most of them but banished any memory of them to the darkest recesses of my mind. Except for Kevin Jarvis. I very seriously have no idea who he is. I still think Baseball Reference might be playing a joke on me.

Hey, that's it... that's all of them. Here's a pie chart.

Wasn't that fun? Now, please, whoever is GM of the Sox next year... please pay someone to get rid of John Lackey. I can't take this much longer.

Boycott Bank of America

I've had it. Trying to hijack the rule of law (via our state AGs) was bad enough. Initiating a back-door TARP (via state-owned Fannie Mae) was even worse. But a third stealth taxpayer-funded bailout is just too many. Three strikes, you're out.

This is an absolute joke, and it's not even close to legal. The FDIC does not exist in order to backstop failed bets from investment banks and trading desks. Attempting to use the taxpayer-backed institution that way is nothing short of theft, and all Americans (not just BofA account holders) should be furious--the FDIC itself already is.

The fact is, the "toxic assets" that caused the financial crisis of 2008-09 never actually went away--they were simply hidden from the public view via a suspension of mark-to-market accounting (itself a borderline crime via accounting fraud). These assets have bounced around for a couple of years, never regaining value, and now the banks are trying to park them in your backyard--if you still have one.

The banks (and their cronies at the Fed, and the politicians whose campaigns they've funded) have consistently gambled that you won't understand the technical details of the fraud, and therefore won't be upset. So far, they've been disturbingly correct, and they've gotten away with pointing a gun at the head of the taxpayer time and time again by threatening "financial Armageddon". But things are changing, and Occupy Wall Street (OWS) is the result--these people may not now exactly how they've been robbed, but they certainly know the results, and they're fed up.

Of course, there are those who have tried to brand the OWS people as "socialists" or "Marxists". I can hardly conceive of a more offensive (and flagrantly false) depiction. While there may be pockets of whackos involved here (just as there were in the Tea Party--eventually, the fringe hijacked that movement), the core values of the movement are anything but socialist. At the center of OWS is a demand that these socialized institutions be held responsible for their losses, and not be backstopped by the government or taxpayers. How is it socialist to demand equality under the law, and to demand that bad banks be allowed to fail?

Occupy Wall Street is, ultimately, a revolution against the concept of "Too Big To Fail"--that very concept is, indisputably, anti-capitalist. A system that does not allow an institution to fail even when the market has said that it must is hardly capitalist--it's socialist. It requires an amazing act of mental gymnastics to suggest that opposing socialist acts... is somehow Marxist. But this is what our banks and politicians are trying to do.

If you've got assets with Bank of America, don't wait until November 5th. Pull them now. No, don't pull it for the traditional "is my money safe?" reasons. Pull it to send a message that you refuse to backstop bad bets by investment bankers, that you refuse to subsidize their ridiculous salaries, and that you refuse to continue to be a part of this badly broken system.

Bank of America put themselves in this situation. It's not your job to save them, and if you do, you're only paving the way for more bailouts (and $5 debit card fees) in the future. The extortion must end now.

[Bloomberg]

Bank of America Corp. (BAC), hit by a credit downgrade last month, has moved derivatives from its Merrill Lynch unit to a subsidiary flush with insured deposits, according to people with direct knowledge of the situation.

The Federal Reserve and Federal Deposit Insurance Corp. disagree over the transfers, which are being requested by counterparties... The Fed has signaled that it favors moving the derivatives to give relief to the bank holding company, while the FDIC, which would have to pay off depositors in the event of a bank failure, is objecting, said the people. The bank doesn’t believe regulatory approval is needed, said people with knowledge of its position.

Three years after taxpayers rescued some of the biggest U.S. lenders, regulators are grappling with how to protect FDIC- insured bank accounts from risks generated by investment-banking operations. Bank of America, which got a $45 billion bailout during the financial crisis, had $1.04 trillion in deposits as of midyear, ranking it second among U.S. firms.

“The concern is that there is always an enormous temptation to dump the losers on the insured institution,” said William Black, professor of economics and law at the University of Missouri-Kansas City and a former bank regulator. “We should have fairly tight restrictions on that.”In the words of Bruce Wayne, the details of this ridiculous bailout attempt are "a bit technical," so I'll put it in layman's terms for you--Bank of America just backed a pickup truck full of toxic horseshit from its investment bank into your backyard, and dumped it all there. Now it's your job to clean it up.

This is an absolute joke, and it's not even close to legal. The FDIC does not exist in order to backstop failed bets from investment banks and trading desks. Attempting to use the taxpayer-backed institution that way is nothing short of theft, and all Americans (not just BofA account holders) should be furious--the FDIC itself already is.

The fact is, the "toxic assets" that caused the financial crisis of 2008-09 never actually went away--they were simply hidden from the public view via a suspension of mark-to-market accounting (itself a borderline crime via accounting fraud). These assets have bounced around for a couple of years, never regaining value, and now the banks are trying to park them in your backyard--if you still have one.

The banks (and their cronies at the Fed, and the politicians whose campaigns they've funded) have consistently gambled that you won't understand the technical details of the fraud, and therefore won't be upset. So far, they've been disturbingly correct, and they've gotten away with pointing a gun at the head of the taxpayer time and time again by threatening "financial Armageddon". But things are changing, and Occupy Wall Street (OWS) is the result--these people may not now exactly how they've been robbed, but they certainly know the results, and they're fed up.

Of course, there are those who have tried to brand the OWS people as "socialists" or "Marxists". I can hardly conceive of a more offensive (and flagrantly false) depiction. While there may be pockets of whackos involved here (just as there were in the Tea Party--eventually, the fringe hijacked that movement), the core values of the movement are anything but socialist. At the center of OWS is a demand that these socialized institutions be held responsible for their losses, and not be backstopped by the government or taxpayers. How is it socialist to demand equality under the law, and to demand that bad banks be allowed to fail?

Occupy Wall Street is, ultimately, a revolution against the concept of "Too Big To Fail"--that very concept is, indisputably, anti-capitalist. A system that does not allow an institution to fail even when the market has said that it must is hardly capitalist--it's socialist. It requires an amazing act of mental gymnastics to suggest that opposing socialist acts... is somehow Marxist. But this is what our banks and politicians are trying to do.

If you've got assets with Bank of America, don't wait until November 5th. Pull them now. No, don't pull it for the traditional "is my money safe?" reasons. Pull it to send a message that you refuse to backstop bad bets by investment bankers, that you refuse to subsidize their ridiculous salaries, and that you refuse to continue to be a part of this badly broken system.

Bank of America put themselves in this situation. It's not your job to save them, and if you do, you're only paving the way for more bailouts (and $5 debit card fees) in the future. The extortion must end now.

[Bloomberg]

Tuesday, October 18, 2011

Quote of the Week

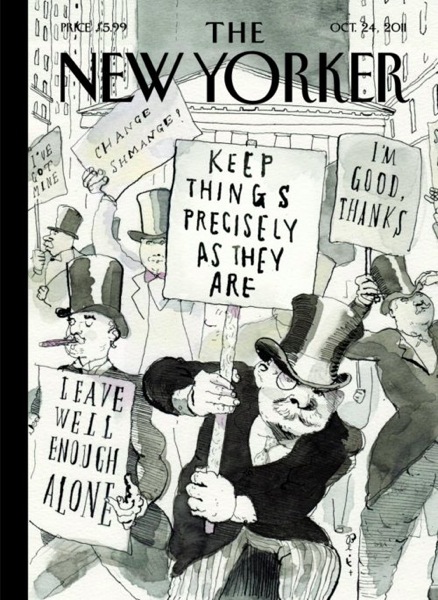

This week, as I often do, I'm going to cheat a bit on Quote of the Week, and use it as an excuse to post a pretty clever cover from the New Yorker, pertaining to Occupy Wall Street.

For Quote of the Week, we'll just go with the guy in the background with the "I'm good, thanks" poster. He's my favorite.

I think I'm gonna start to walk around carrying a sign that says "I'm good, thanks," just to see how people respond to me. Actually maybe I'll just print up some t-shirts. Who wants one?

For Quote of the Week, we'll just go with the guy in the background with the "I'm good, thanks" poster. He's my favorite.

I think I'm gonna start to walk around carrying a sign that says "I'm good, thanks," just to see how people respond to me. Actually maybe I'll just print up some t-shirts. Who wants one?

Monday, October 17, 2011

Woo-hoo!

It might have gone unnoticed in some circles (and I neglected to mention it here), but a very long and illustrious era nearly came to a very unceremonious end last week.

So while the Simpsons may have lost its fastball a few seasons ago, it's still worth a watch, and I'm just not ready for it to be out of my life just yet. And if nothing else, Hank Azaria just amuses the hell out of me. Glad they're still gonna be around.

[CBS News]

[Chicago Sun-Times]

After more than 20 years, the curtain could finally be coming down on "The Simpsons."

A standoff is reportedly underway between the studio and the show's actors over their multimillion dollar salaries. And if an agreement isn't reached, the show could be canceled for good, reports CBS News correspondent Bill Whitaker.

The show holds the record as the longest-running sitcom in the history of broadcasting. But after 23 seasons and nearly 500 episodes, the very future of "The Simpsons" may hang in the balance over a reported pay dispute between Twentieth Century Fox and the actors that provide the voices of the show's beloved characters.

"Basically, the studio would like to see the voice actors take a pretty huge pay cut in order to justify the increasingly skyrocketing expense of doing a show that's been on the air for 23 years," Andrew Wallenstein, TV editor for Variety magazine, tells CBS News.Nooooooooooooo!!! Oh... thank God.

Fans of “The Simpsons” can breathe a “d’oh!” of relief: The animated series was renewed Friday for two more seasons.

A contract dispute with the show’s voice cast had threatened to end the series, but Fox announced it will air through seasons 24 and 25.

The animated series about the Simpson family, including dad Homer and his familiar “D’oh!” is TV’s longest-running scripted nighttime series.

So, I'll admit I'm not exactly an unbiased observer in this situation, because I love The Simpsons. I've clearly watched too much of the show in my life (like, the majority of my four years in college), so much so that I regularly quote it in my daily life ("I am so smart, S-M-R-T"... "the goggles, they do nothing"... "inflammable means flammable? What a country!), some of the songs from the show are deeply and irreparably ingrained in my head ("Can I Borrow A Feeling", "Dr. Zaius Dr. Zaius", "Yvan eht Nioj", and so forth), and that I've seriously considered naming my first-born son "Max", because yeah... Max Powers.Negotiations over the future of “The Simpsons,” which began its 23rd season last month, spilled out into the public. Twentieth Century Fox Television, which makes the show, said it couldn’t continue without cutting costs and targeted the salaries of voice actors Harry Shearer, Dan Castellaneta, Julie Kavner, Nancy Cartwright, Yeardley Smith and Hank Azaria.

So while the Simpsons may have lost its fastball a few seasons ago, it's still worth a watch, and I'm just not ready for it to be out of my life just yet. And if nothing else, Hank Azaria just amuses the hell out of me. Glad they're still gonna be around.

[CBS News]

[Chicago Sun-Times]

Interesting related graphics (and how they relate to Occupy Wall Street)

I've already posted Jon Stewart's terrific take on Occupy Wall Street here, and if you're looking for an equally well-executed (albeit much less humorous) summary of the situation, I'd suggest you read this piece from Barry Ritholtz. He correctly points the finger not only at Wall Street execs, but also at Washington, the mainstream media, and even the Supreme Court.

Ritholtz also warns that if the Occupy Wall Street movement isn't careful, it could suffer the same fate as the Tea Party--that is, being co-opted by a partisan political message that over-simplifies and distorts the original themes of the movement for the benefit of an established political party. In the initial stages of a movement or protest, disorganization doesn't really matter, but eventually it does--people (especially those in the media) are always looking for a coherent narrative, and they'll find it wherever they can.

At any rate, in that vein, I was struck by a couple of charts (appropriately enough, all brought to my attention by the very same Barry Ritholtz) that I came across this weekend, and they seemed both related and relevant. I'll leave the conclusions to you.

The first is a series of charts showing the changing distribution of income gains in the U.S. over the past century (culled from this interactive graphic).

Related to that is a graphic showing which Presidents were responsible for the majority of our country's debt accumulation. (Note: I always take these "debt by President" charts with a massive grain of salt, because it's always difficult--if not impossible--to properly assess "blame" to one President or another for certain long-standing projects or proposals. If TARP was passed by Bush but enacted under Obama's watch, who bears the brunt of that debt hit? What about tax cuts, and then the extension of those tax cuts? And do we give Obama a free pass for certain of his policies that are certain to create debt in the future, even if they haven't officially done so yet? As a result, the findings of these types of charts have a tendency to be... a bit inconsistent. But they're generally consistent in a range--like, it's indisputable that George W. accumulated significantly more debt than Clinton--if not in specific numbers and percentages. They're far from statistically perfect, and therefore heavily prone to statistical manipulation to suit the artists' needs. But if you appreciate that fact, they can still be interesting.)

Alright, that's it for now. That should at least help explain why so many people are so angry, and why they're out in the streets (that and the fact that they're unemployed and really have nothing better to do). Good times.

Ritholtz also warns that if the Occupy Wall Street movement isn't careful, it could suffer the same fate as the Tea Party--that is, being co-opted by a partisan political message that over-simplifies and distorts the original themes of the movement for the benefit of an established political party. In the initial stages of a movement or protest, disorganization doesn't really matter, but eventually it does--people (especially those in the media) are always looking for a coherent narrative, and they'll find it wherever they can.

At any rate, in that vein, I was struck by a couple of charts (appropriately enough, all brought to my attention by the very same Barry Ritholtz) that I came across this weekend, and they seemed both related and relevant. I'll leave the conclusions to you.

The first is a series of charts showing the changing distribution of income gains in the U.S. over the past century (culled from this interactive graphic).

|

| Between 1917 and 1981, the bottom 90% received 69% of income gains. |

|

| Between 1982 and 2000, the bottom 90% received just 23% of income gains. |

|

| Since 2001, incomes for the bottom 90% have declined. The top 10% have still gained. |

Related to that is a graphic showing which Presidents were responsible for the majority of our country's debt accumulation. (Note: I always take these "debt by President" charts with a massive grain of salt, because it's always difficult--if not impossible--to properly assess "blame" to one President or another for certain long-standing projects or proposals. If TARP was passed by Bush but enacted under Obama's watch, who bears the brunt of that debt hit? What about tax cuts, and then the extension of those tax cuts? And do we give Obama a free pass for certain of his policies that are certain to create debt in the future, even if they haven't officially done so yet? As a result, the findings of these types of charts have a tendency to be... a bit inconsistent. But they're generally consistent in a range--like, it's indisputable that George W. accumulated significantly more debt than Clinton--if not in specific numbers and percentages. They're far from statistically perfect, and therefore heavily prone to statistical manipulation to suit the artists' needs. But if you appreciate that fact, they can still be interesting.)

Alright, that's it for now. That should at least help explain why so many people are so angry, and why they're out in the streets (that and the fact that they're unemployed and really have nothing better to do). Good times.

Friday, October 14, 2011

More jokes in the mainstream media

It's getting a little crazy how the mainstream media keeps accidentally publishing articles that were supposed to run in The Onion, isn't it? First there was this article about the North Carolina governor's suggestion that we suspend Congressional elections so that our elected officials can keep doing the great job they've been doing. That was good for a laugh.

Now there's this article in Businessweek, discussing the Italian government's plan to begin drug testing the country's stock traders, because obviously their cocaine use--and not the government's excessive use of debt--is to blame for recent stock market volatility.

When did our whole political process become an episode of The Simpsons? This is really rich stuff, guys. Keep up the good work, leaders of the free world.

[Businessweek]

Now there's this article in Businessweek, discussing the Italian government's plan to begin drug testing the country's stock traders, because obviously their cocaine use--and not the government's excessive use of debt--is to blame for recent stock market volatility.

An undersecretary for Italian Prime Minister Silvio Berlusconi has proposed a drug-testing program for stock traders, citing studies that point to a “worrisome” link between substance abuse and market fluctuations.

Some Italians may have entrusted savings to people “not capable of making decisions” due to drug use, Carlo Giovanardi said in a phone interview today from Belluno, Italy.

Giovanardi, who’s responsible for the government’s family and drug-abuse prevention policy, said he plans to contact regulators and industry groups working with the stock exchange to discuss the drug-testing plan. The program could be developed without the passage of a new law, he said.This is good stuff. It gets even better and more Onion-y, and I took the liberty of editing the next paragraph for Businessweek.

Giovanardi, who last year promoted a voluntary drug test for members of parliament, also cited “U.S. studies” suggesting recent market turmoil may have been amplified by “There. That's better. Seriously, I'm getting really tired of the misdirection plays being employed by politicians around the world to distract from the core problem of too much government debt. It's not the debt that's the problem... it's CHINA! No, it's the IMMIGRANTS! No, it's those drug-popping stock traders, they're the real problem!!peoplepoliticians and central bankers who’ve lost touch with reality” due to drug use. The undersecretary said cocaine use has a “devastating” effect onindividualspoliticians, leading to “brain meltdown.”

When did our whole political process become an episode of The Simpsons? This is really rich stuff, guys. Keep up the good work, leaders of the free world.

[Businessweek]

Thursday, October 13, 2011

Clip of the Week

Alright, I got my ranting out of my system yesterday (actually, there's more to come, but whatever...), so now it's time for Clip of the Week. Of course, Clip of the Week isn't always immune from ranting and complaining--just give this video a quick watch and you'll know that it was hard for me to contain myself after watching it.

But I'm looking for some happier stuff this week. Happy stuff like this really cool time-lapse video of some beautiful landscapes. Or this video of Steelers safety Troy Polamalu pretending to be a wax statue to scare small children (honestly, that would have been my Clip of the Week, but the Cowboy scooped me on it too soon--so be it, he's better at this stuff than I am).

There's also this amusing parody movie trailer, "Too Much Moneyball"--the inspiring story of the Yankees' amazing ability to overcome absolutely no obstacles and win championships. That's a winner.

But this time, I'm just going to go ahead and give a nod to nature. Yeah, humans may rule the world now... but they still can't hold a candle to an antelope in a street fight. BOOM!

But I'm looking for some happier stuff this week. Happy stuff like this really cool time-lapse video of some beautiful landscapes. Or this video of Steelers safety Troy Polamalu pretending to be a wax statue to scare small children (honestly, that would have been my Clip of the Week, but the Cowboy scooped me on it too soon--so be it, he's better at this stuff than I am).

There's also this amusing parody movie trailer, "Too Much Moneyball"--the inspiring story of the Yankees' amazing ability to overcome absolutely no obstacles and win championships. That's a winner.

But this time, I'm just going to go ahead and give a nod to nature. Yeah, humans may rule the world now... but they still can't hold a candle to an antelope in a street fight. BOOM!

Wednesday, October 12, 2011

Yup... this is fair

I don't have enough words to describe my anger right now. This is ridiculous. And if you think this is unique to the U.K. and that stuff like this couldn't (or doesn't) happen here, wake up. This is the world you live in, and this has everything to do with the way that politics are done in our country.

These guys play by different rules than the rest of us, plain and simple. There is no equality under the law, and the more stuff that comes out like this, the more clear that becomes. I'm furious. But don't worry... they're doing God's work. Wall Street is our Main Street. I say, fuck that. There's a reason people are "occupying Wall Street" right now--this is that reason.

[Guardian]

(h/t Michael)

Britain's tax authorities have given Goldman Sachs an unusual and generous Christmas present, leaked documents reveal. In a secret London meeting last December with the head of Revenue, the wealthy Wall Street banking firm was forgiven £10m interest on a failed tax avoidance scheme.

HM Revenue and Customs sources admit privately that the interest-free deal is "a cock-up" by officials, but refuse to say who was responsible.

Documents leaked to Private Eye magazine and published in full by the Guardian record that Britain's top tax official, HMRC's permanent secretary Dave Hartnett, personally shook hands on a secret settlement last December.

Hartnett is due to be questioned on Wednesday by the Commons public accounts committee. The leaked documents suggest that a previous PAC chairman, Edward Leigh, was misled when he was told it was illegal to reveal details of such cases to parliament...

The £10m Christmas gift for Goldman was the culmination of a prolonged attempt by the US firm to avoid paying national insurance on huge bonuses for its bankers working in London.

The sum was pocket change to Goldman, whose employees received $15.3bn (£9.5bn) in pay and bonuses last year. Its Wall Street head, Lloyd Blankfein, received $68m in 2008 and at the height of Britain's banking crisis 100 London partners set their bonuses at £1m each. This level was considered a mark of restraint.

In the 1990s, Goldman set up a company offshore in the British Virgin Islands. This entity, called Goldman Sachs Services Ltd, supposedly employed all of Goldman's London bankers, who were then "seconded" to work there.

The device appears to have been designed to conceal the size of the bonuses. Judge David Williams said in 2009 that it was "a way of keeping information about the GS accounts and payroll out of the public domain and confidential".There is literally no lengths these guys won't go to in order to line their bank accounts. They don't care who suffers as a result, they care only about their own egos. I absolutely despise Goldman, but I'm also not naive enough to think that they're alone in this kind of behavior.

These guys play by different rules than the rest of us, plain and simple. There is no equality under the law, and the more stuff that comes out like this, the more clear that becomes. I'm furious. But don't worry... they're doing God's work. Wall Street is our Main Street. I say, fuck that. There's a reason people are "occupying Wall Street" right now--this is that reason.

[Guardian]

(h/t Michael)

Quote of the Week

Whoops. I didn't post anything for Quote of the Week yesterday. As often seems to be the case, it's actually a good thing, because I didn't hear the Quote of the Week until last night.

I'm pretty much constantly watching sports on TV, and I'm just about as constantly complaining about the (low) quality of the color commentators, especially those who used to be athletes. It generally doesn't seem like they do even a little bit of research before covering the games they cover (if they did, they might actually be able to properly pronounce the names of the guys on the field--seems basic, but it's often not), and their insight in general is typically... weak.

There are of course plenty of exceptions to this rule, but it's much easier for me to bring up a list of commentators I dislike than one of commentators that I actually like. Keep in mind that I'm not talking about play-by-play guys, where there's actually still a lot of talent, but color guys, which have gotten worse by the year. But throughout the years, there's always been one guy who's stood out above all the rest... and been unquestionably the worst color commentator in the world for over a decade.

Tim McCarver, how do you still have a job?

This week's QUOTE OF THE WEEK

"That swing is like syrup."

- Tim McCarver, on Texas Rangers outfielder Josh Hamilton

What the hell? What does that mean? It goes great on pancakes and waffles? It's... kinda slow-moving and sticky? It's part of a balanced breakfast? I... meh. Whatever. Go Tigers... I think.

I'm pretty much constantly watching sports on TV, and I'm just about as constantly complaining about the (low) quality of the color commentators, especially those who used to be athletes. It generally doesn't seem like they do even a little bit of research before covering the games they cover (if they did, they might actually be able to properly pronounce the names of the guys on the field--seems basic, but it's often not), and their insight in general is typically... weak.

There are of course plenty of exceptions to this rule, but it's much easier for me to bring up a list of commentators I dislike than one of commentators that I actually like. Keep in mind that I'm not talking about play-by-play guys, where there's actually still a lot of talent, but color guys, which have gotten worse by the year. But throughout the years, there's always been one guy who's stood out above all the rest... and been unquestionably the worst color commentator in the world for over a decade.

Tim McCarver, how do you still have a job?

This week's QUOTE OF THE WEEK

"That swing is like syrup."

- Tim McCarver, on Texas Rangers outfielder Josh Hamilton

What the hell? What does that mean? It goes great on pancakes and waffles? It's... kinda slow-moving and sticky? It's part of a balanced breakfast? I... meh. Whatever. Go Tigers... I think.

Monday, October 10, 2011

Jon Stewart on "Occupy Wall Street"

I haven't really been able to piece together my thoughts on the growing Occupy Wall Street phenomenon, and I'm certainly not alone. The difficulty in assessing this situation/movement/protest is that we all want it to be some cohesive, coherent, easy-to-categorize group, when in reality it's anything but--and that's exactly what makes it so important.