In this morning's Washington Post, Ben Bernanke pens an incredibly deceptive op-ed to justify yesterday's announcement by the Fed that it will engage in another $600 billion of "quantitative easing" over the next 6-8 months. Bernanke's transparent attempt to legitimize his outright market manipulation is both politically disingenuous and academically fraudulent.

The Fed's so-called "dual mandate" is to promote price stability and maximum employment. This quantitative easing (or "QE", or "QE2" since this is the second round of easing) not only will not achieve those goals, but also goes far beyond the Fed's mission and authority. Direct market intervention of this sort is NOT part of the Fed's mission, and it is as blunt a statement as any quasi-government organization has ever made that it flat out does not care to allow free-market capitalism. You can label President Obama a socialist all you want; the truth is that Ben Bernanke (and Alan Greenspan before him) has done more to disrupt the free flow of commerce and to force a government-led economy than any politician ever could. It's frankly unconstitutional, and Bernanke's weak attempts at self-justification hold no water.

Fellow blogger (and angry man) Karl Denninger wrote a post last night detailing the inaccuracies and deliberate deceptions in Bernanke's op-ed. I won't enumerate them here, but I will focus on the biggest problem of all. Bernanke writes (emphasis mine),

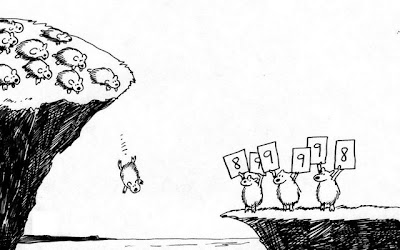

Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.Oh, crap. Ignoring for a minute that explicitly targeting higher stock prices goes WAY beyond the Fed's mandate and authority, the type of supply-side policies that Bernanke is now promoting can and will have disastrous results. He is directly espousing a plan that will nominally enrich the richest (those who own stocks) by inflating asset prices, to the detriment of the poor. I've mentioned here many times that inflation disproportionately hurts the poor, who cannot trade down from steak to hamburger or from a mansion to a townhouse--they've already traded down.

Furthermore, the "wealth effect" that Bernanke is now espousing DOES NOT create long-lasting economic growth. The inflation he creates may lead to higher sales for corporations, and nominal GDP growth as a result, but it will also reflect itself in their input costs. Therefore, the companies do not actually become more profitable, they simply sell more goods as measured in dollars. Without any real growth, they will have no reason or incentive to hire new workers. For evidence of this dynamic, note that Bernanke's first round of QE has spurred a stock market rally of 20-25% (depending on your measuring stick) since the end of August, with no actual economic growth or increased employment to show for it.

The best case scenario to result from QE2 is a stock market and commodity bubble. At best, this might feel good for a while, and keep the economy kicking for a few years (like from 2004-2007), but the prosperity will be both illusory and fleeting. The "benefits" to Bernanke's QE are already exhibiting diminishing returns, and if the current course is held, the eventual crash will be incredibly long-lasting, if not as dramatic and devastating as the events of 2008.

Bernanke has staked his career on the concept of QE; he gained great notoriety for his remarks on what Japan could have done differently to avoid its decades-long economic malaise (which we now seem destined to repeat), with QE at the center of his arguments. It became a centerpiece of his so-called "Bernanke Doctrine", which helped lead him to his initial nomination as Fed chairman. Despite zero empirical evidence to support his claims of the benefits of QE (he relies only on the assumptions within his economic models), Bernanke now stands poised to unleash a wild economic science experiment on the world's largest economy, at a time when it can ill afford a failed experiment. This is not good policy.

To rely on Bernanke's untested economic models at this time shows not only how desperate we all are for an immediate fix to the economy's ailments (news flash: there isn't one), but also how much blind faith we are willing to place in policies that we don't fully understand. Remember, Bernanke is the same man who in 2004 opined that improvements in monetary policy had ushered in a new era of low macroeconomic volatility, wherein large-scale economic shocks were no longer a relevant concern. Whoops. And yet, this is the same man on whose economic models we are now gambling our nation's (and the world's) economic prosperity. Seems a bit dangerous, no?

Typically when an economist or a banker devises a scheme that ordinary Americans (and even many well-educated Americans) have trouble fully understanding, it's a warning sign that the scheme is probably bad news in the long run. Stable economies require that all participants (however small) understand all of the relevant risks and rewards of their actions. A fundamental and widespread misunderstanding of mortgage-market mechanisms (caused in part by unprecedented financial engineering by the banks) helped inflate the real estate bubble, with disastrous consequences. We have all spent years now villainizing the banks for their role in our previous economic crisis, but we now stand by and watch as the biggest bank of them all (the Fed) repeats the sins of the past. The worst part of it all is that most Americans won't know that they're being screwed over (or how) until it's too late. Just like 2008.

There is no such thing as a free lunch anywhere in the world, and there is similarly no miraculously positive outcome to the Fed's latest batch of financial alchemy. At best, America will experience a further increase in the gap between rich and poor, and long-lasting economic stagnation that would put Japan's malaise to shame. At worst, these Fed policies could spur hyperinflation and a complete collapse in our nation's currency. Since the dollar has become the world's reserve currency, this collapse would be a horrific outcome for the global economy. What Bernanke is betting is that the entire world will step in and prevent our dollar collapse in order to help save themselves. That's too dangerous a game to play when the entire world's prosperity is at stake.

Any "fiscal conservatives" who think they just saved the country by electing a group of tea party whackos to "stop spending" need to think again. With fiscal stimulus now relegated to "not gonna happen" status by the coming Republican majority, this leaves Ben Bernanke's monetary policy as the sole tool for economic stimulus. And this is what he's come up with. All of this means that the only true friend that fiscal conservatives have left is Ron Paul. Good luck.

[Washington Post]

No comments:

Post a Comment