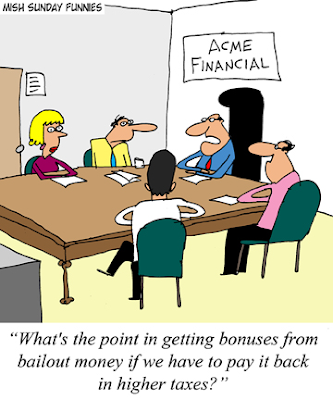

Here's the bottom line: Without any taxes, accepting that editor’s assignment would have yielded my children an extra $10,000. With taxes, it yields only $1,000. In effect, once the entire tax system is taken into account, my family’s marginal tax rate is about 90 percent. Is it any wonder that I turn down most of the money-making opportunities I am offered?It's easy to criticize the analysis here, in large part because relatively few Americans are as hyper hyper hyper rational as our macroeconomic friend Mankiw. The reality of the situation is that very few Americans will work their way through all the math to determine the true economic benefit of additional work. More money is more money, and so his analysis is somewhat irrelevant (especially since relatively few Americans will even face his particular economic predicament).

But the implication for tax policy is clear: simply put, tax structure skews incentives. If we raise taxes, we simply cannot assume that all of the economic players will continue to make all of the same choices as under the previous tax regime. Therefore, if we are to close budget gaps in any predictable fashion, it MUST always come from the spending side first, not the tax side.

It's easy to write Mankiw off because of his ties to the Bush administration (he was the chairman of W's Council of Economic Advisors), and thereby decry his policies as Reagan-style "voodoo economics". And I, too, am very clearly suspicious of government deficits in any scenario, and Republican economic policies in general.

But I took classes from Greg Mankiw, and I know that his policies are far different from those of anyone in Washington. As a Keynesian economist, he advocates running budget deficits in recessions, with the MASSIVE caveat that spending must be rolled back and turned into budgetary surpluses during boom times. This type of policy provides the buffer that our economy needs when things get a dicey, preventing the backs-to-the-wall type of fiscal situation that we now face. Mankiw certainly does NOT advocate structural deficits and ballooning national debt, nor does traditional Keynesian theory. This is a critical distinction.

That Mankiw's policies are politically unrealistic (because cutting back on government programs is political suicide in any economic environment, so almost all government spending becomes permanent) is not really Mankiw's fault--it's our politicians' fault. So-called "Keynesians" in Washington today are not really Keynesians at all, since they advocate and welcome the accumulation of a national debt.

Regardless of your political views, however, Mankiw's take on taxes is of critical importance. Any discussion on taxes and budget deficits must take these types of incentive structures into account.

[New York Times]

No comments:

Post a Comment